MeaWallet Supports Central Cooperative Bank in Launching Click to Pay Push Provisioning for Mastercard and Visa

19 May - MeaWallet, a leading digital payments enabler specialising in card tokenization, proudly announces its support for Central Cooperative Bank in launching Click to Pay push..

Read More

MeaWallet Partners with Backbase to Deliver Advanced Tokenization Solutions in Australia and New Zealand

19 February - MeaWallet, a leader in tokenization and digital payment solutions, announces its partnership with Backbase, the creator of the Engagement Banking Platform. This..

Read More

Click to Pay - Time to get onboard

Key takeaways The rollout of Click to Pay has been mandated for certain regions, in line with local regulations. Click to Pay transforms online payments by hiding sensitive card..

Read More

Click to Pay - All you need to know

Key takeaways Click to Pay removes card entry hassle, storing encrypted details securely for a smoother checkout experience .Open to all, Click to Pay levels the playing field for..

Read More

MeaWallet Partners with Integrated Finance to Enhance Digital Wallet and Secure Card Data Access for Fintechs

20 November - MeaWallet, a leader in tokenization and digital payment solutions, has announced a strategic partnership with Integrated Finance, an innovative fintech IpaaS..

Read More

MeaWallet Introduces New Features to Support Click to Pay, Enabling Safer, Faster Online Shopping

5 November - MeaWallet, a leading digital payments enabler specialising in card tokenization, today announced several updates to its products in support of Click to Pay. The Click..

Read More

MeaWallet Partners with Toqio to Expand its Digital Card Capabilities

22 October - MeaWallet a leading digital payments enabler specialising in card tokenization announces its partnership with Toqio, a leading technology platform for B2B embedded..

Read More

MeaWallet and B89 Join Forces to Enhance Digital Payments with Advanced Tokenization

09 October - MeaWallet a leading digital payments enabler specialising in card tokenization announces its partnership with B89, a pioneering TechFin (fintech fully driven by..

Read More

MeaWallet Wins Gold for "Network Tokenization Solution" at Juniper Research Fintech and Payments Future Digital Awards 2024

08 October - MeaWallet, the leading digital payments enabler specialising in card and payments tokenization, has been named the Gold Winner of the Network Tokenization Solution..

Read More

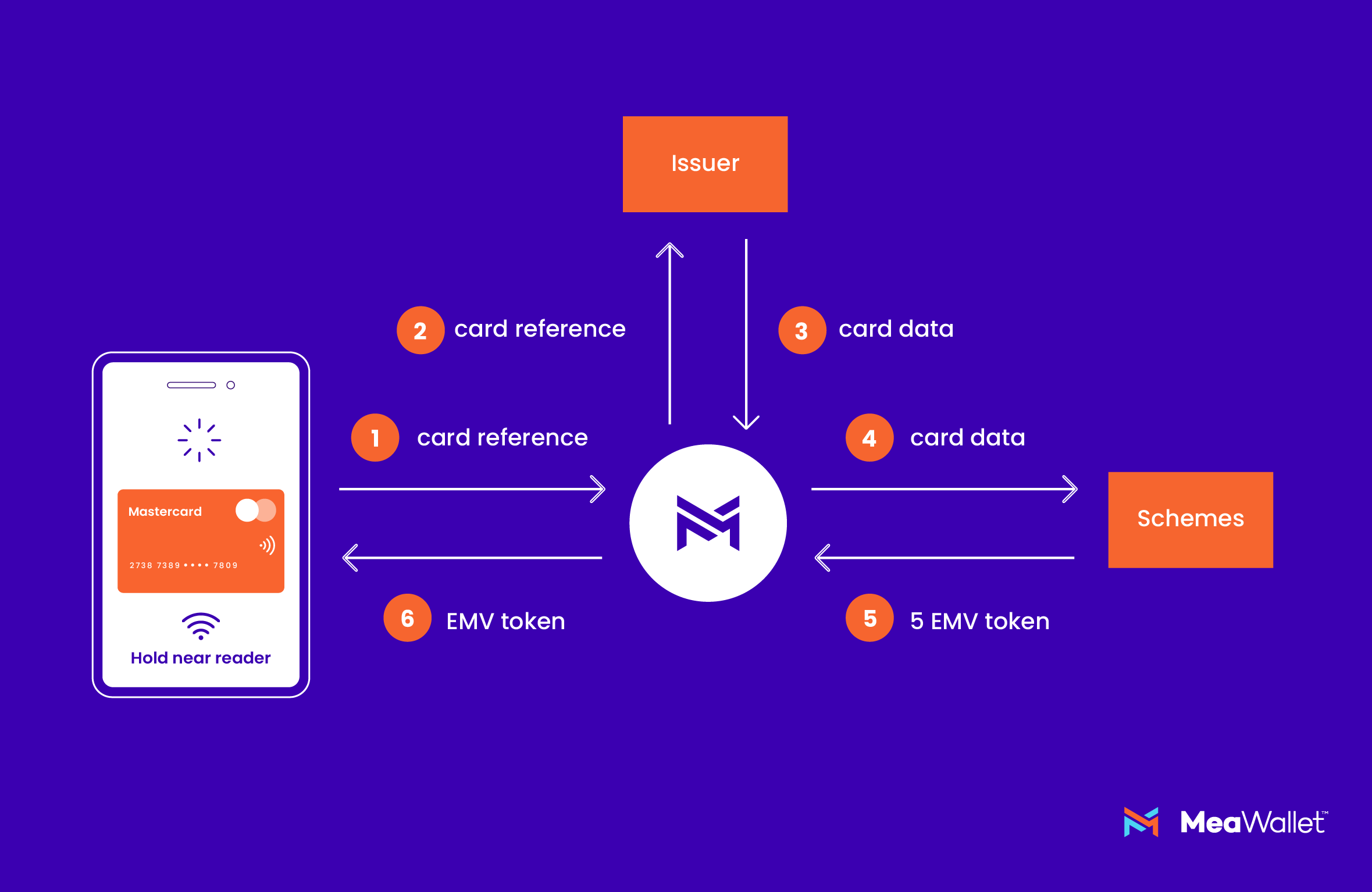

How EMV Tokenization Keeps Your Payments Safe

Key takeaways EMV tokenization is your card’s protective shield. Tokens act just like regular PANs, so everything keeps running smoothly. Tokens can be carefully managed from..