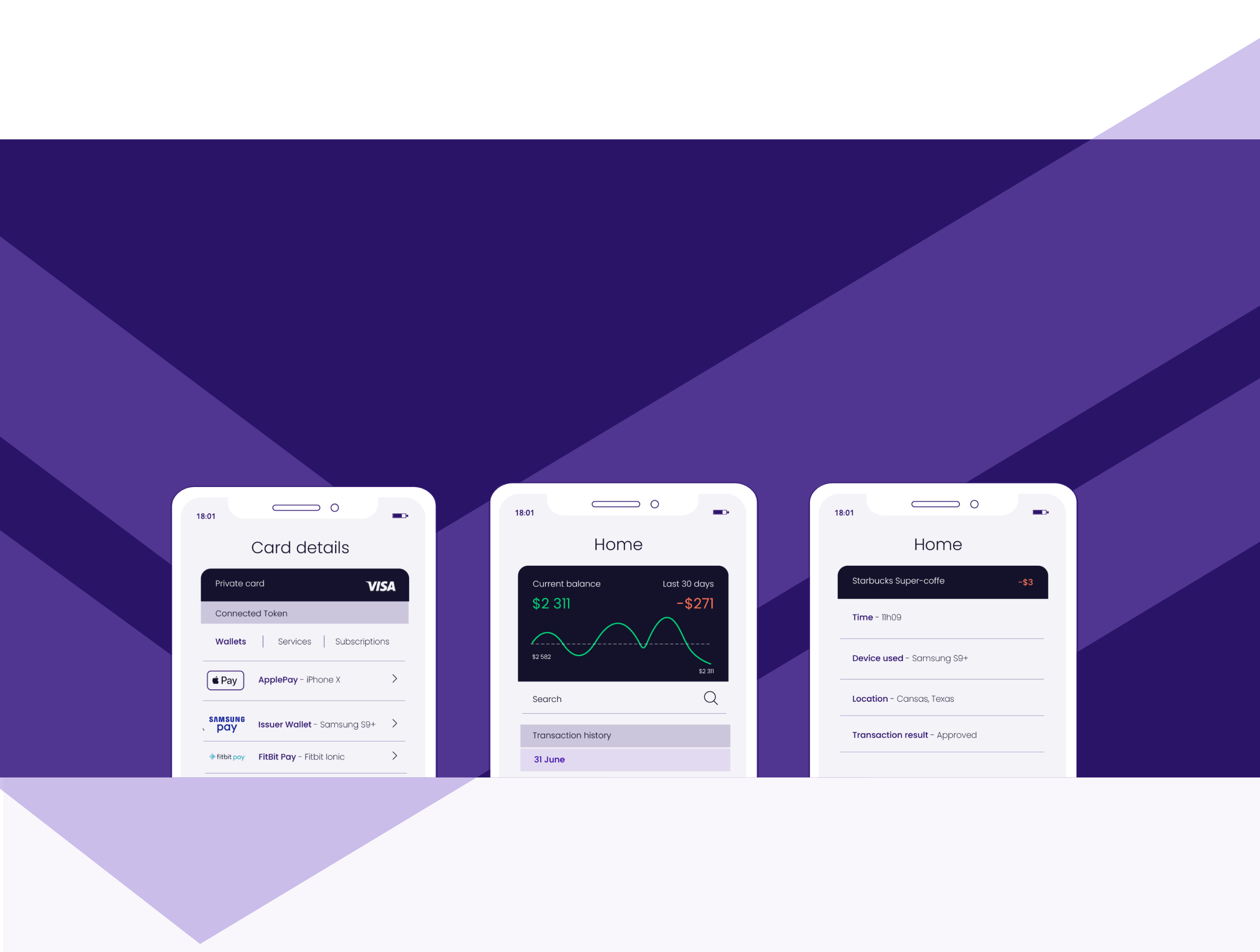

Digital payment solutions for card issuers and merchants

Are you looking to implement a mobile wallet or improve the user experience of your payment solutions? Join the ranks of businesses that have experienced remarkable results with MeaWallet.

We can help you with:

Why MeaWallet?

10+ years

of tokenisation and payment industry experience

Certified partner

of Mastercard, Visa, American Express, and eftpos

One platform,

one integration point for all major card schemes and wallets

Modular products,

compatible with other solutions

Easy onboarding

and working wallet within three months

Flexible pricing,

no start-up costs

Latest blogs

MeaWallet Supports Central Cooperative Bank in Launching Click to Pay Push Provisioning for Mastercard and Visa

19 May - MeaWallet, a leading digital payments enabler specialising in card tokenization, proudly announces its support for Central Cooperative Bank...

MeaWallet Partners with Backbase to Deliver Advanced Tokenization Solutions in Australia and New Zealand

19 February - MeaWallet, a leader in tokenization and digital payment solutions, announces its partnership with Backbase, the creator of the...

Click to Pay - Time to get onboard

Key takeaways The rollout of Click to Pay has been mandated for certain regions, in line with local regulations. Click to Pay transforms online...

Click to Pay - All you need to know

Key takeaways Click to Pay removes card entry hassle, storing encrypted details securely for a smoother checkout experience .Open to all, Click to...

.webp?width=626&name=paymentology_logo%20(meawallet).webp)