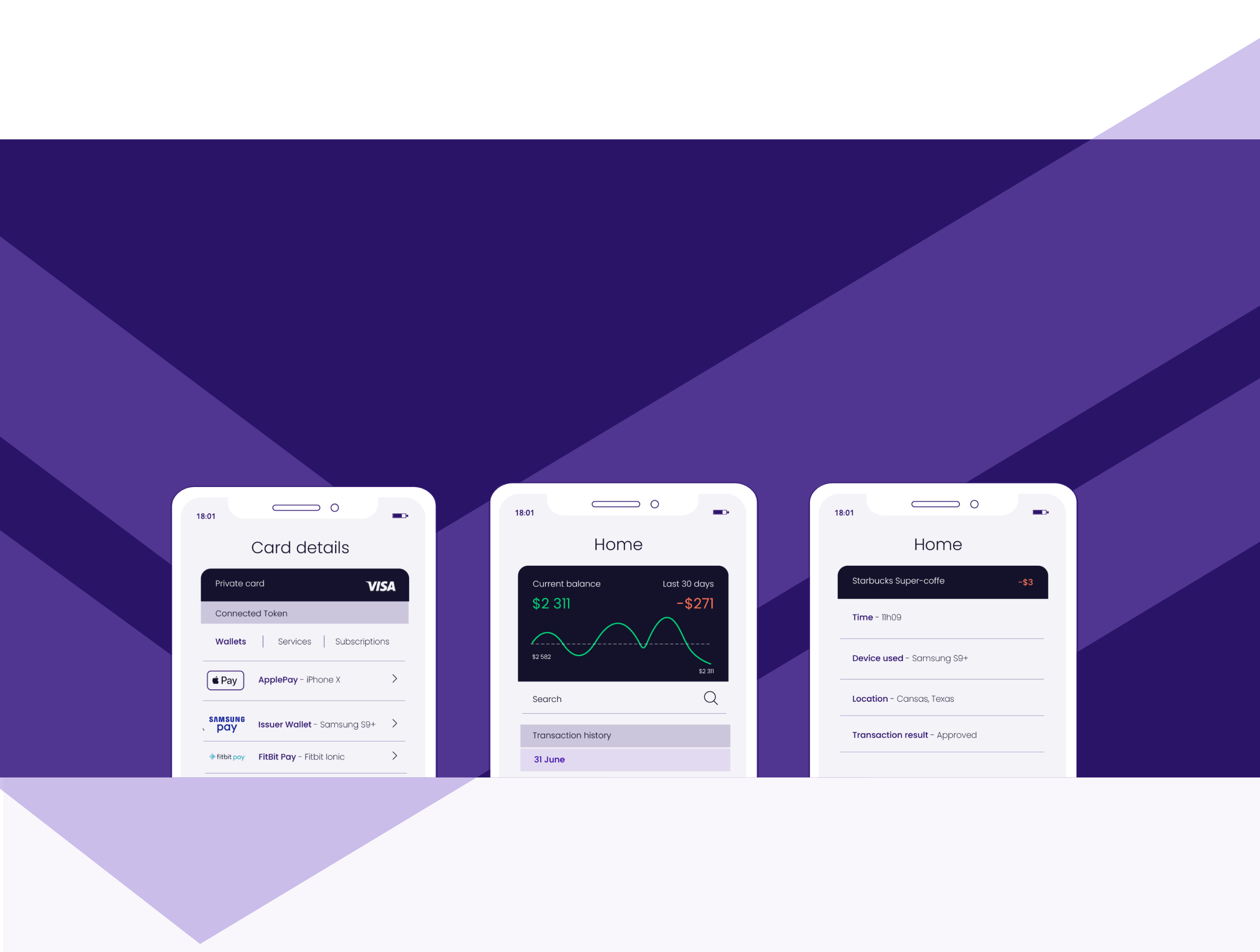

Digital payment solutions for card issuers and merchants

Are you looking to implement a mobile wallet or improve the user experience of your payment solutions? Join the ranks of businesses that have experienced remarkable results with MeaWallet.

We can help you with:

Why MeaWallet?

10+ years

of tokenisation and payment industry experience

Certified partner

of Mastercard, Visa, American Express, and eftpos

One platform,

one integration point for all major card schemes and wallets

Modular products,

compatible with other solutions

Easy onboarding

and working wallet within three months

Flexible pricing,

no start-up costs

Latest blogs

MeaWallet Achieves PCI DSS v4.0 Certification with 7Security, Reinforcing Commitment to Payment Data Security

03 April - MeaWallet, a leading digital payments enabler renowned for its expertise in card tokenization, announces its achievement of the PCI DSS...

MeaWallet Launches Mea Card Gateway: A Secure and Flexible Platform for Handling Payment Card Data

20 March - MeaWallet, a leading digital payments enabler specialising in card tokenization, today announces the launch of its global Mea Card...

MeaWallet Provides Tokenization Services for Fondeadora

13 March - MeaWallet, a leading digital payments enabler specialising in card tokenization, announces its partnership with Fondeadora, Mexico's...

MeaWallet Crowned Winner for Issuance – Agility at Mastercard Excellence Awards in LAC

7 March - MeaWallet, a leading digital payments enabler specialising in card tokenization, proudly announces its recognition as the winner of the...

.webp?width=626&name=paymentology_logo%20(meawallet).webp)