Mobile wallets for all your payment needs

Mea Issuer Pay / Mea OEM Pay

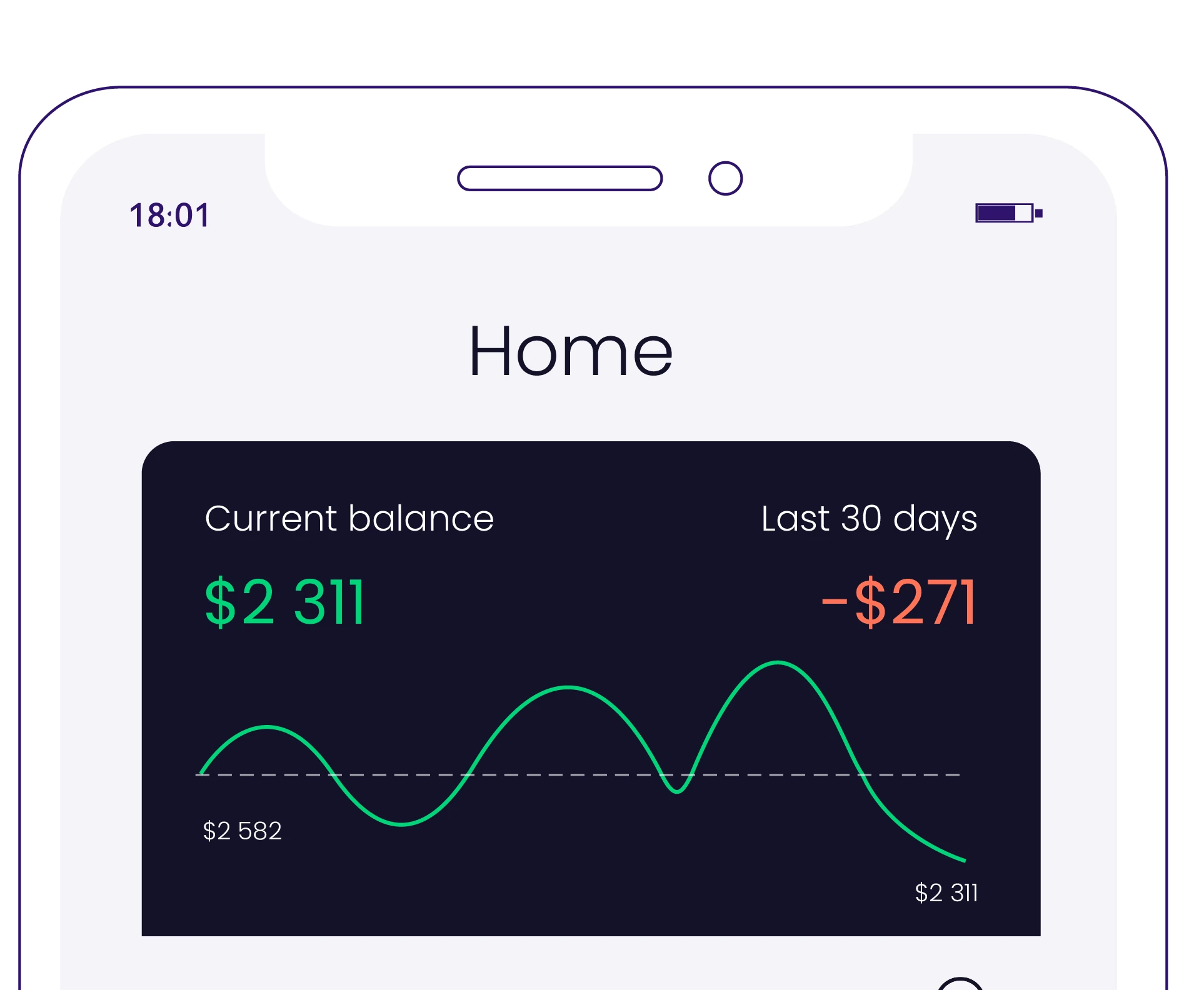

Mobile wallets enable your customers to leave their physical wallets at home and pay from the comfort of their phones. Tap into the network of an established OEM wallet like Google Pay or Apple Pay, or enable NFC payments for your own banking app.

Which wallet implementation is right for you?

If you are unsure which wallet to go with, our handy guide “How to get started with mobile wallets”.

-

Different types of mobile wallets

-

Their relative strengths

-

How to combine them

-

Features and requirements

-

What a launch project looks like, including timelines

You are also very welcome to contact us and ask us any questions you may have.

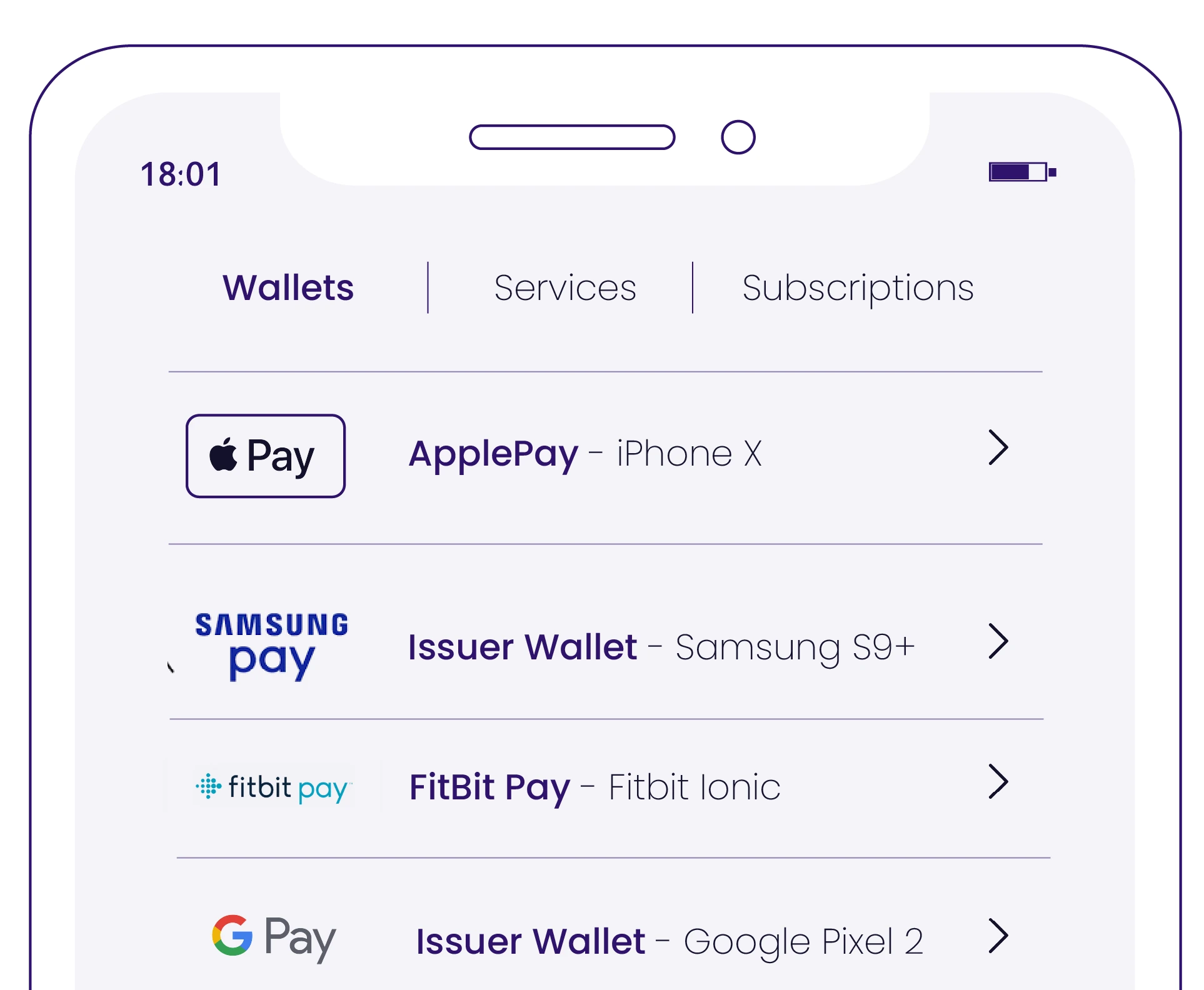

OEM wallets

Digitise any card and enable payments with any OEM through a single connection.

-

Access all major OEM wallets

-

Support all major payment schemes through a single connection

-

Secure, compliant, and certified

-

Easy to implement

-

Fast time to market

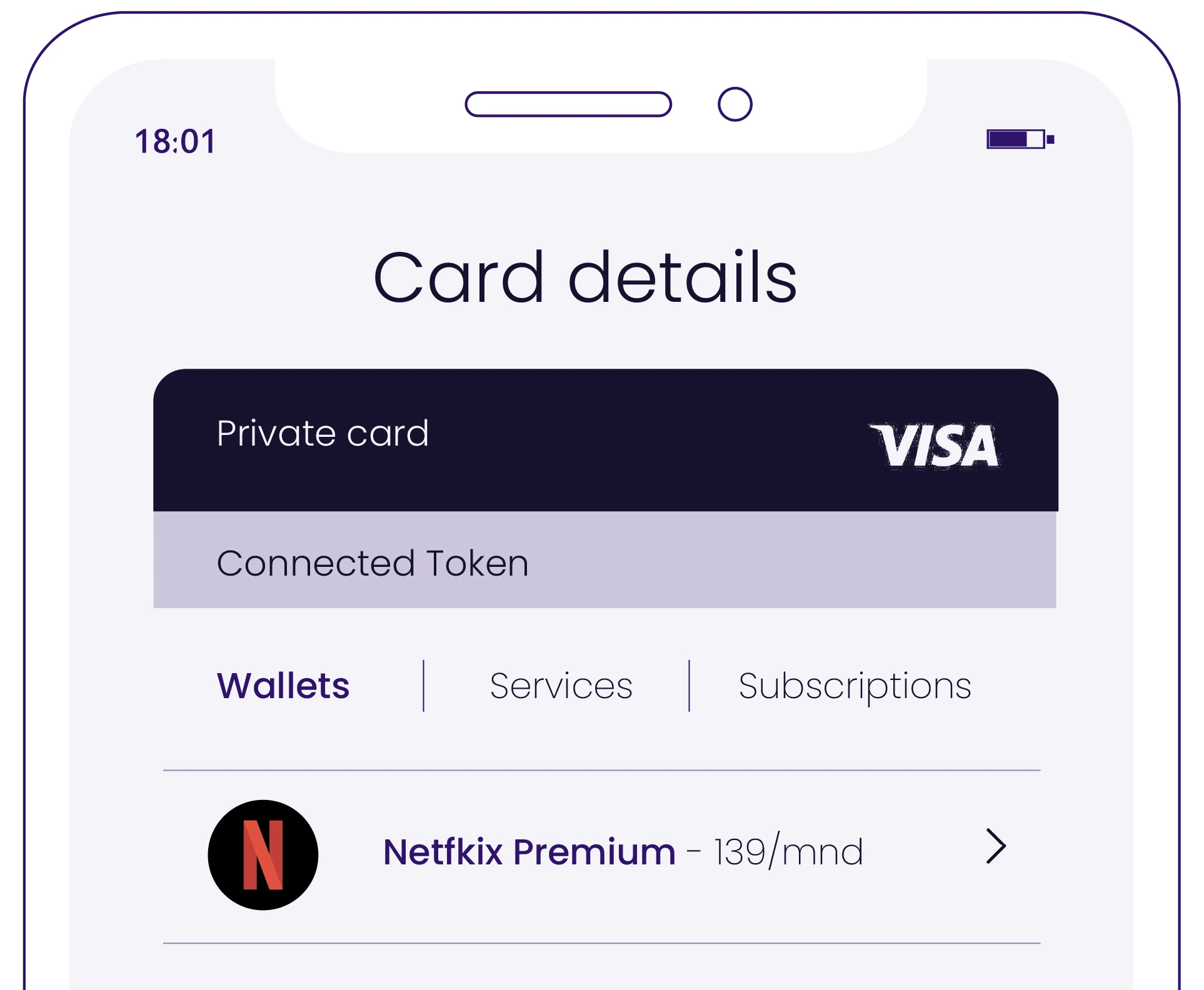

Issuer wallets

Your bespoke mobile payment application turns your banking app into a mobile wallet with contactless payment functionality.

-

Add tap&pay and wallet capabilities to your banking app

-

Digitise, issue, store, and activate cards with seconds

-

Use biometrics and face recognition to authenticate payments

-

Access all payment schemes

-

Add branding elements, customisations, and extensions

All our mobile wallets are

-

Connected to all major payment schemes through one connection

-

Secure, compliant, and certified

-

Kept up to date with the latest regulations and payment scheme programs, so you don’t have to

Mobile wallet – Use Cases

Mobile Wallets for traditional banks

Lower operational costs by reducing the need for physical interactions, physical cards and paperwork.

Increase spending and usage by offering incentives, discounts, or cashback rewards for customers who use their mobile wallets for transactions.

Use customer data, such as spending patterns, preferences and behaviors to create personalized offerings.

Improve security and fraud prevention with features like biometric authentication, encryption, and tokenization.

Remain competitive in the digital banking landscape and keep up with digital-first banks.

Mobile Wallets for neobanks

Mobile wallets enable digital-first payment services.

A scalable solution that can handle a growing customer base and increasing transaction volumes.

Offer competitive fee structures thanks to low operational and overhead costs.

Provide a seamless user experience with intuitive interfaces, real-time notifications, and personalized features to build loyalty with your digital-savvy customers.

Use customer data from mobile wallet usage to improve your services, personalize offers, and provide targeted financial advice.

Use your mobile wallet as a gateway to partnerships within the fintech ecosystem and open access to investment platforms, P2P payments, budgeting tools, and more.

Mobile Wallets for telecommunication companies

Open a new revenue stream with an existing user base.

Provide customers with a convenient and integrated platform to manage their mobile plans, make payments, and access value-added services such as mobile top-ups, data packages, and roaming services.

Increase customer satisfaction, loyalty and retention by integrating payment features, loyalty programs, and personalized offers within the mobile wallet.

Offer a simplified payment experience by integrating your billing systems with the mobile wallet, allowing customers to pay their bills directly from your app.

Expand your ecosystem and collaborate with financial institutions, retailers, or service providers to offer joint promotions, discounts, or exclusive offers through the mobile wallet.

Tailor your offers, provide relevant recommendations, and deliver personalized campaigns based on wallet data.

Attract new customers and improve brand loyalty with your one-stop-shop for telecom services, payments, and value-added features.

Mobile Wallets for fintechs

Provide a unified platform and user-friendly interface for customers to access fintech services.

Send push notifications and personalized offers to encourage active usage of fintech services.

Ensures the protection of sensitive financial information and mitigates the risk of fraud.

Generate a wealth of customer data and personalize your offerings, tailor recommendations, and provide targeted financial advice to your customers.

Work together with partners to extend your capabilities and provide a comprehensive financial ecosystem within the mobile wallet.

Scale your solution at your own pace.

Roll out updates, enhancements, or integrations more efficiently compared to traditional financial institutions and stay ahead of the competition.

Lower operational costs by reducing the need for physical interactions, physical cards and paperwork.

Increase spending and usage by offering incentives, discounts, or cashback rewards for customers who use their mobile wallets for transactions.

Use customer data, such as spending patterns, preferences and behaviors to create personalized offerings.

Improve security and fraud prevention with features like biometric authentication, encryption, and tokenization.

Remain competitive in the digital banking landscape and keep up with digital-first banks.

Mobile wallets enable digital-first payment services.

A scalable solution that can handle a growing customer base and increasing transaction volumes.

Offer competitive fee structures thanks to low operational and overhead costs.

Provide a seamless user experience with intuitive interfaces, real-time notifications, and personalized features to build loyalty with your digital-savvy customers.

Use customer data from mobile wallet usage to improve your services, personalize offers, and provide targeted financial advice.

Use your mobile wallet as a gateway to partnerships within the fintech ecosystem and open access to investment platforms, P2P payments, budgeting tools, and more.

Open a new revenue stream with an existing user base.

Provide customers with a convenient and integrated platform to manage their mobile plans, make payments, and access value-added services such as mobile top-ups, data packages, and roaming services.

Increase customer satisfaction, loyalty and retention by integrating payment features, loyalty programs, and personalized offers within the mobile wallet.

Offer a simplified payment experience by integrating your billing systems with the mobile wallet, allowing customers to pay their bills directly from your app.

Expand your ecosystem and collaborate with financial institutions, retailers, or service providers to offer joint promotions, discounts, or exclusive offers through the mobile wallet.

Tailor your offers, provide relevant recommendations, and deliver personalized campaigns based on wallet data.

Attract new customers and improve brand loyalty with your one-stop-shop for telecom services, payments, and value-added features.

Provide a unified platform and user-friendly interface for customers to access fintech services.

Send push notifications and personalized offers to encourage active usage of fintech services.

Ensures the protection of sensitive financial information and mitigates the risk of fraud.

Generate a wealth of customer data and personalize your offerings, tailor recommendations, and provide targeted financial advice to your customers.

Work together with partners to extend your capabilities and provide a comprehensive financial ecosystem within the mobile wallet.

Scale your solution at your own pace.

Roll out updates, enhancements, or integrations more efficiently compared to traditional financial institutions and stay ahead of the competition.

Mobile Wallets for traditional banks

Lower operational costs by reducing the need for physical interactions, physical cards and paperwork.

Increase spending and usage by offering incentives, discounts, or cashback rewards for customers who use their mobile wallets for transactions.

Use customer data, such as spending patterns, preferences and behaviors to create personalized offerings.

Improve security and fraud prevention with features like biometric authentication, encryption, and tokenization.

Remain competitive in the digital banking landscape and keep up with digital-first banks.

Mobile Wallets for neobanks

Mobile wallets enable digital-first payment services.

A scalable solution that can handle a growing customer base and increasing transaction volumes.

Offer competitive fee structures thanks to low operational and overhead costs.

Provide a seamless user experience with intuitive interfaces, real-time notifications, and personalized features to build loyalty with your digital-savvy customers.

Use customer data from mobile wallet usage to improve your services, personalize offers, and provide targeted financial advice.

Use your mobile wallet as a gateway to partnerships within the fintech ecosystem and open access to investment platforms, P2P payments, budgeting tools, and more.

Mobile Wallets for telecommunication companies

Open a new revenue stream with an existing user base.

Provide customers with a convenient and integrated platform to manage their mobile plans, make payments, and access value-added services such as mobile top-ups, data packages, and roaming services.

Increase customer satisfaction, loyalty and retention by integrating payment features, loyalty programs, and personalized offers within the mobile wallet.

Offer a simplified payment experience by integrating your billing systems with the mobile wallet, allowing customers to pay their bills directly from your app.

Expand your ecosystem and collaborate with financial institutions, retailers, or service providers to offer joint promotions, discounts, or exclusive offers through the mobile wallet.

Tailor your offers, provide relevant recommendations, and deliver personalized campaigns based on wallet data.

Attract new customers and improve brand loyalty with your one-stop-shop for telecom services, payments, and value-added features.

Mobile Wallets for fintechs

Provide a unified platform and user-friendly interface for customers to access fintech services.

Send push notifications and personalized offers to encourage active usage of fintech services.

Ensures the protection of sensitive financial information and mitigates the risk of fraud.

Generate a wealth of customer data and personalize your offerings, tailor recommendations, and provide targeted financial advice to your customers.

Work together with partners to extend your capabilities and provide a comprehensive financial ecosystem within the mobile wallet.

Scale your solution at your own pace.

Roll out updates, enhancements, or integrations more efficiently compared to traditional financial institutions and stay ahead of the competition.

Connect with our experts

Embrace digital payments. Enable tokenized payments on any wallet. Fast.